Introduction

In the dynamic world of finance, staying updated on economic events is vital for investors, policymakers, and businesses alike. The U.S. economic calendar is a comprehensive tool that provides a schedule of key economic indicators, government reports, and central bank announcements that can significantly impact financial markets. In this article, we will delve into the importance of the U.S. economic calendar, explore the various indicators it encompasses, and discuss strategies to make informed decisions based on this critical resource.

Understanding The U.S. Economic Calendar

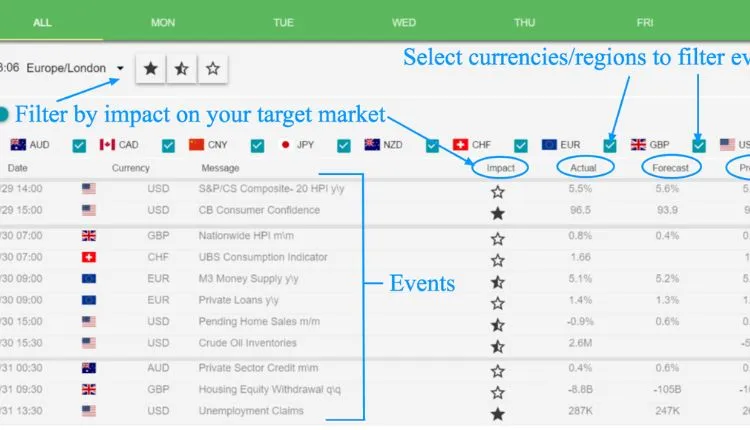

The U.S. economic calendar is a centralized platform that compiles a wide range of economic events. From unemployment reports to GDP growth figures, these indicators offer valuable insights into the health of the nation’s economy and can influence market sentiments worldwide. This comprehensive resource is made available by various financial news outlets, government agencies, and private organizations, ensuring accessibility to market participants across the globe.

Key Economic Indicators

- Gross Domestic Product (GDP): GDP is one of the most crucial indicators as it represents the total value of goods and services produced within a country’s borders. It serves as a barometer for economic growth and contraction, guiding investors and policymakers in understanding the overall economic health.

- Employment Reports: Employment figures, including non-farm payrolls and the unemployment rate, provide critical data on the labor market’s strength. Changes in employment numbers can have significant implications for consumer spending and, consequently, economic growth.

- Consumer Price Index (CPI): The CPI measures inflation by tracking changes in the prices of a basket of consumer goods and services. This indicator is closely monitored by central banks as it influences monetary policy decisions and affects interest rates.

- Federal Reserve Announcements: Statements from the Federal Reserve regarding interest rate decisions, monetary policy outlook, and economic projections can cause substantial market volatility. Traders closely analyze these announcements for clues about future economic conditions.

- Housing Market Indicators: Data on housing starts, building permits, and home sales offer insights into the health of the real estate sector, which plays a significant role in the overall economy.

Impacts On Financial Markets

The release of key economic data often triggers notable reactions in financial markets. Investors and traders quickly respond to surprises or deviations from expectations. For example, if the employment report shows better-than-expected job growth, it may lead to a rally in the stock market as investors perceive it as a sign of a strong economy. Conversely, disappointing numbers might prompt investors to seek safer assets, leading to a decline in equities.

Volatility in currency markets is also common during economic events. Central bank announcements, in particular, can cause substantial currency fluctuations as investors reassess their positions based on the revealed monetary policy stance.

Strategies For Utilizing The Economic Calendar

- Planning Ahead: Traders and investors must plan their strategies based on the economic calendar. By knowing when critical data releases are scheduled, they can adjust their positions or choose to stay on the sidelines during potentially turbulent periods.

- Monitoring Consensus Forecasts: Consensus forecasts, which reflect the average predictions of economists and analysts, are often available before the actual data release. Monitoring these forecasts can help market participants gauge market expectations and anticipate potential market reactions.

- Risk Management: Volatility during economic events can be significant, and unexpected outcomes may result in sudden losses. Implementing appropriate risk management practices, such as setting stop-loss orders, can protect traders from excessive downside risks.

Conclusion

The U.S. economic calendar is a powerful tool that empowers market participants with valuable information about economic conditions and events. Traders, investors, and policymakers rely on this resource to make informed decisions and adapt to changing economic landscapes. By understanding the significance of key indicators and employing effective strategies, individuals can navigate the economic calendar with confidence and stay ahead in the ever-evolving financial markets.

FAQs:

- Why is the U.S. economic calendar essential for international investors?

The U.S. economic calendar is vital for international investors because the United States plays a crucial role in the global economy. As the world’s largest economy and the issuer of the world’s primary reserve currency (the U.S. dollar), economic events in the U.S. have far-reaching impacts on financial markets worldwide. International investors closely monitor U.S. economic indicators to make informed decisions about their global investment portfolios.

- How often is the U.S. economic calendar updated, and where can I access it?

The U.S. economic calendar is regularly updated to include newly scheduled economic events and revised release dates. Market participants can access the calendar through various financial news websites, economic data providers, and government agencies. Popular sources include Bloomberg, Investing.com, and the U.S. Bureau of Economic Analysis (BEA) website. It is recommended to cross-reference multiple sources to ensure accuracy and to stay informed about any last-minute changes to the schedule.